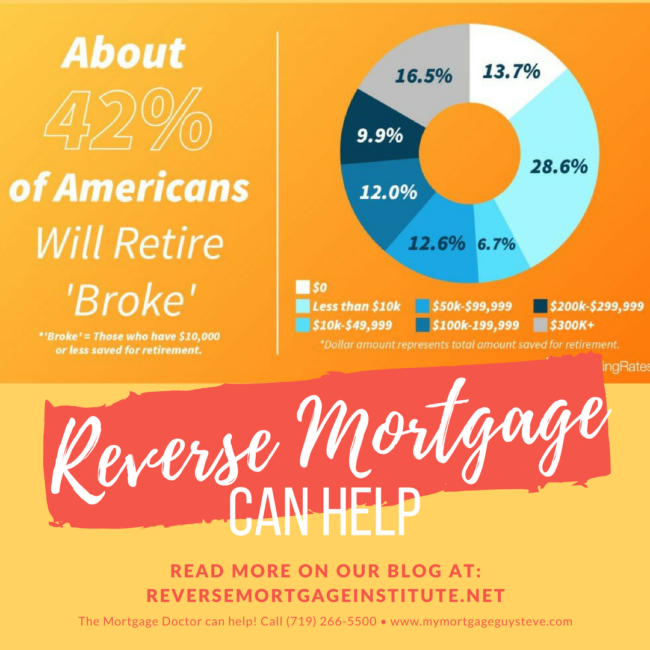

Over 40 percent of Americans will retire broke: The 2018 Retirement Savings survey found that 42 percent of Americans have less than $10,000 saved. If you don’t boost your savings, you’ll likely retire broke because that’s not enough to cover a year’s worth of expenses. On average, adults 65 and older spend almost $46,000 a year, according to the Bureau of Labor Statistics.

Included in that 42 percent with less than $10,000 saved is the 14 percent of respondents with absolutely nothing saved for retirement. This group could be at the most risk of retiring broke if they don’t start taking steps to catch up on retirement savings.

On the other hand, the survey found that the majority of Americans have more than $10,000 saved for retirement.

– Nearly 7 percent said they have $10,000 to $49,999 saved.

– Nearly 13 percent said they have $50,000 to $99,999.

– More than 12 percent said they have $100,000 to $199,999.

– Nearly 10 percent have $200,000 to $299,999.

– About 16 percent have $300,000 or more in retirement savings.

Men are still more likely than women to have larger retirement account balances. The 2018 survey found that 45 percent of women have no savings or $10,000 or less, compared with 40 percent of men. However, that’s an improvement from 2017, when 58 percent of women had no savings or less than $10,000 saved. In 2016, 63 percent of women had less than $10,000 saved or nothing at all.

Are you concerned that you will retire broke? Find out how a reverse mortgage could help you have a better retirement. Call Steve Haney, The Mortgage Doctor, today at: (719) 266-5500. He will sit with you and determine if a reverse mortgage could help make your retirement a little less stressful.

A reverse mortgage can eliminate your monthly mortgage payment and even give you cash every month. This can allow you to be able to visit the grandchildren, take a vacation, or take up a new hobby. If you won’t have enough money to enjoy your retirement, consider a reverse mortgage!